Introduction

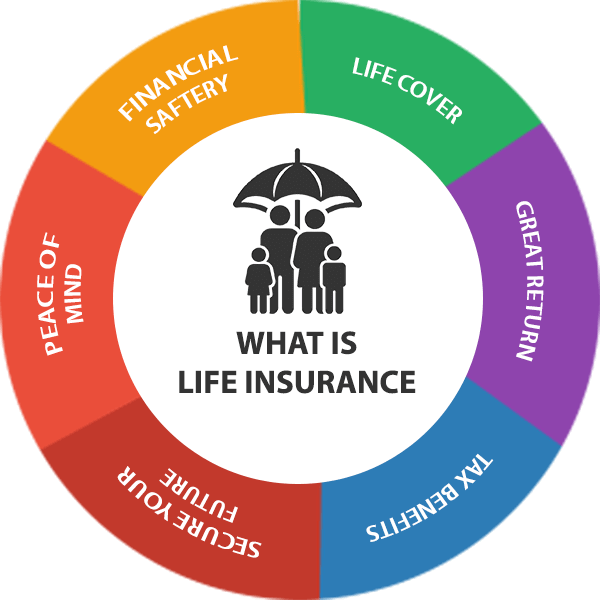

When we hear “life insurance,” the first thing that often comes to mind is protection—specifically, financial protection for our loved ones after we’re gone. While this is the cornerstone of what life insurance offers, the benefits extend far beyond this fundamental aspect. Life insurance is not just about leaving behind a legacy; it’s about creating a strategic financial tool that offers multiple, life-changing advantages. From providing a safety net to opening up opportunities for wealth transfer and even aiding in charitable endeavors, the spectrum of benefits is broad and often surprising.

1. Financial Security for Your Family

The primary purpose of life insurance is to provide financial security to those we care about most. In the event of an unexpected departure, it ensures that our loved ones are not left with a financial burden. This means covering everyday living expenses, securing mortgage payments, and ensuring educational costs are met, allowing your family to maintain their standard of living without compromise.

2. Debt Protection

One of the less talked about but critically important benefits of life insurance is debt protection. In the absence of the policyholder, outstanding debts such as personal loans, credit card debts, and even mortgages can become a significant burden for family members. Life insurance can cover these debts, ensuring that your family’s financial health is preserved.

3. Wealth Transfer

Life insurance can serve as an efficient tool for transferring wealth to the next generation. The death benefit from a policy is generally tax-free, providing a significant financial legacy to heirs without the tax burdens often associated with other forms of inheritance.

4. Charitable Contributions

A life insurance policy can be designated to support charitable causes, allowing you to leave a lasting legacy beyond your immediate family. This is not only a way to contribute to causes you care about but can also provide tax benefits to your estate.

5. Living Benefits

Some life insurance policies come with an option known as “living benefits,” allowing policyholders to access a portion of the death benefit under certain conditions, such as terminal illness. This can provide financial relief when it’s most needed, without waiting for the policy to mature upon death.

6. Tax Advantages

Beyond the tax-free death benefit, life insurance can offer other tax advantages, including tax-deferred growth of cash value in certain types of policies, such as whole life insurance. This can make life insurance a strategic part of your overall tax planning.

7. Forced Savings Plan

Certain life insurance policies, like whole life or universal life, accumulate cash value over time. This can act as a forced savings plan, offering a way to build a cash reserve that grows at a guaranteed rate and can be borrowed against if needed.

8. Business Protection

For business owners, life insurance can protect the business in the event of the death of a key person by providing a financial cushion. It can also be used in buy-sell agreements to ensure the smooth transition of ownership.

9. Supplemental Retirement Income

The cash value accumulated in a life insurance policy can be used as supplemental income during retirement. Policyholders can borrow against the policy or even cash it in, providing financial flexibility in their golden years.

10. Peace of Mind

Ultimately, the overarching benefit of life insurance is the peace of mind it provides. Knowing that your loved ones will be financially secure and that you have leveraged a tool for financial planning offers immense emotional and mental relief.

Conclusion

Life insurance is much more than a payout upon death; it’s a versatile financial tool that can benefit policyholders and their families in numerous ways. Understanding these benefits can transform how you view and utilize life insurance in your overall financial strategy.